16+ Current buffett indicator News

Home » News » 16+ Current buffett indicator NewsYour Current buffett indicator bitcoin are available in this site. Current buffett indicator are a exchange that is most popular and liked by everyone now. You can Download the Current buffett indicator files here. Find and Download all free news.

If you’re searching for current buffett indicator pictures information related to the current buffett indicator topic, you have visit the right site. Our website frequently gives you hints for refferencing the highest quality video and image content, please kindly hunt and locate more informative video content and graphics that fit your interests.

Current Buffett Indicator. Back in 2001 he remarked in a Fortune Magazine interview that it is probably the best single measure of where valuations stand at any given moment. When the market line is below the GNP line the investment environment is favorable to value investors like. Lately the Buffett Indicator has been flashing a warning sign about the stock market. As of 2021-11-21 030504 PM CST updates daily.

Simple And Profitable Fibonacci Scalper Forex Trading Strategy Scalper Fibonacci Trading Strategies From pinterest.com

Simple And Profitable Fibonacci Scalper Forex Trading Strategy Scalper Fibonacci Trading Strategies From pinterest.com

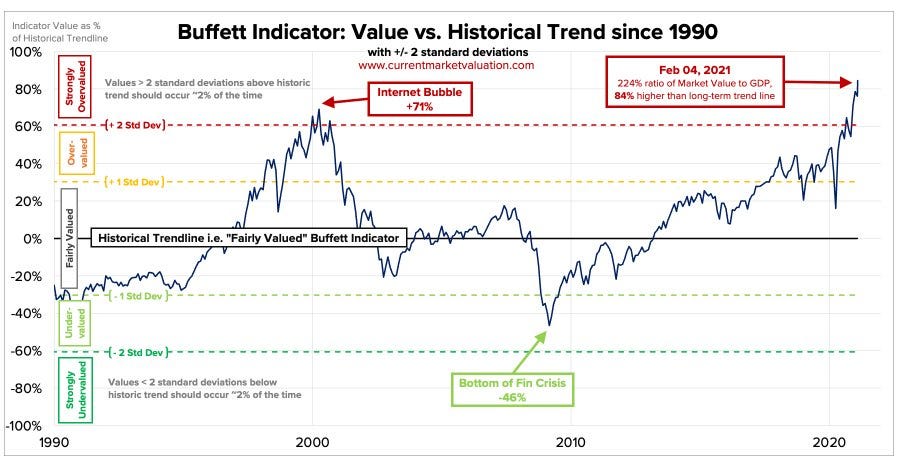

558T 229T 243 By our calculation that is currently 95 or about 31 standard deviations above the historical average suggesting that the market is Strongly OvervaluedThese are historical all-time highs. However with interest rates at historic lows there is reason to suspect that this time is different may hold true. The Buffett Indicator is the ratio of total US stock market valuation to GDP. As of November 11 2021 we calculate the Buffett Indicator as 215 which is about 24 standard deviations above the historical average suggesting that the US stock market is Strongly Overvalued. Meanwhile based on the historical ratio of newly introduced total market cap over GDP plus Total. Back in 2001 he remarked in a Fortune Magazine interview that it is probably the best single measure of where valuations stand at any given moment The four valuation indicators we track in our monthly valuation overview offer a long-term perspective of well over a.

It is easy to see why Buffett would like this indicator.

Back in 2001 he remarked in a Fortune Magazine interview that it is probably the best single measure of where valuations stand at any given moment. Warren Buffetts favorite market indicator has surged to a record high of 142 signaling US and international stocks are heavily overpriced and could plummet in the months ahead. The Buffett Indicator today points to very high valuations and probably to a big opportunity for Buffett to capture alpha relative market performance in the next downturn. This ratio now commonly known as the Buffett Indicator compares the size of the stock market to that of the economy. The Stock Market is Significantly Overvalued according to Buffett Indicator. The stock market capitalization-to-GDP ratio is also known as the Buffett Indicatorafter investor Warren Buffett who popularized its use.

Source: pinterest.com

Source: pinterest.com

The Stock Market is Significantly Overvalued according to Buffett Indicator. Prior to the house of cards falling the ratio was in a nice uptrend. Many outlets have been reporting on this including Fortune Bloomberg the Wall Street Journal Business. Lately the Buffett Indicator has been flashing a warning sign about the stock market. The Indicator has proven very reliable if you turn back timecase in point the 2001 and 2008 crashes.

Source: pinterest.com

Source: pinterest.com

The Stock Market is Significantly Overvalued according to Buffett Indicator. 015 and valuation reverse to the mean -487. The four valuation indicators we track in our monthly valuation overview offer a long-term perspective of well over a. The Stock Market is Significantly Overvalued according to Buffett Indicator. With the SP 500 above 4000 the Buffett Indicator is wildly out of whack.

Source: businessinsider.co.za

Source: businessinsider.co.za

It is easy to see why Buffett would like this indicator. However given that corporations derive their revenue from economic activity the Buffett Indicator suggests investors may be walking into a trap. It provides a historical Buffet Indicator graph and current value plus the median minimum maximum and average value for the indicator. An easy way to analyze if the markets are overvalued is by looking at the Warren Buffett indicator also known as the market cap to gross domestic. Lately the Buffett Indicator has been flashing a warning sign about the stock market.

Source: pinterest.com

Source: pinterest.com

Buffett Indicator is a valuation metric which is used for assessing whether the countrys stock market is overvalued or undervalued compared to its historical average. The ratio has become known as the Buffett Indicator in recent years after the investor Warren Buffett popularized its use. Todays graphic by Current Market. Market Cap to GDP is a long-term valuation indicator for stocks. With the SP 500 above 4000 the Buffett Indicator is wildly out of whack.

Source: in.pinterest.com

Source: in.pinterest.com

An easy way to analyze if the markets are overvalued is by looking at the Warren Buffett indicator also known as the market cap to gross domestic. The Buffett indicator is a simple metric that measures the market capitalisation of the entire US stock market against the gross national product GNP of the US economy. As of 2021-11-21 030504 PM CST updates daily. When the market line is below the GNP line the investment environment is favorable to value investors like. It provides a historical Buffet Indicator graph and current value plus the median minimum maximum and average value for the indicator.

Source: pinterest.com

Source: pinterest.com

The Indicator has proven very reliable if you turn back timecase in point the 2001 and 2008 crashes. However with interest rates at historic lows there is reason to suspect that this time is different may hold true. Back in 2001 he remarked in a Fortune Magazine interview that it is probably the best single measure of where valuations stand at any given moment. Buffett Indicator is a valuation metric which is used for assessing whether the countrys stock market is overvalued or undervalued compared to its historical average. However given that corporations derive their revenue from economic activity the Buffett Indicator suggests investors may be walking into a trap.

Source: pinterest.com

Source: pinterest.com

However with interest rates at historic lows there is reason to suspect that this time is different may hold true. Based on the historical ratio of total market cap over GDP currently at 2097 it is likely to return -33 a year from this level of valuation including dividends. Warren Buffetts favorite market indicator has surged to a record high of 142 signaling US and international stocks are heavily overpriced and could plummet in the months ahead. It provides a historical Buffet Indicator graph and current value plus the median minimum maximum and average value for the indicator. Buffett Indicator is a valuation metric which is used for assessing whether the countrys stock market is overvalued or undervalued compared to its historical average.

Source:

Source:

The stock market is not the economy Such has been the Sirens Song of investors over the last couple of years as valuation expansion has been the sole driver of the markets performance. As of January 21 2020 currently the stock market is s ignificantly overvalued as measured by the Buffett Indicator. The Buffett Indicator today points to very high valuations and probably to a big opportunity for Buffett to capture alpha relative market performance in the next downturn. A high ratio indicates an overvalued marketand as of February 11 2021 the ratio has reached all-time highs indicating that the US. An easy way to analyze if the markets are overvalued is by looking at the Warren Buffett indicator also known as the market cap to gross domestic.

Source: pinterest.com

Source: pinterest.com

Market Cap to GDP is a long-term valuation indicator for stocks. This is from the contribution of economic growth in local current prices. With the SP 500 above 4000 the Buffett Indicator is wildly out of whack. Warren Buffetts favorite market indicator has surged to a record high of 142 signaling US and international stocks are heavily overpriced and could plummet in the months ahead. The four valuation indicators we track in our monthly valuation overview offer a long-term perspective of well over a.

Source: id.pinterest.com

Source: id.pinterest.com

Lately the Buffett Indicator has been flashing a warning sign about the stock market. It provides a historical Buffet Indicator graph and current value plus the median minimum maximum and average value for the indicator. Todays graphic by Current Market. 015 and valuation reverse to the mean -487. Stock market is currently strongly overvalued.

Source: jonathanbaird88-89120.medium.com

Source: jonathanbaird88-89120.medium.com

Todays graphic by Current Market. The stock market capitalization-to-GDP ratio is also known as the Buffett Indicatorafter investor Warren Buffett who popularized its use. Meanwhile based on the historical ratio of newly introduced total market cap over GDP plus Total. Many outlets have been reporting on this including Fortune Bloomberg the Wall Street Journal Business. The Buffett indicator is a simple metric that measures the market capitalisation of the entire US stock market against the gross national product GNP of the US economy.

Source: pinterest.com

Source: pinterest.com

The Buffett Indicator today points to very high valuations and probably to a big opportunity for Buffett to capture alpha relative market performance in the next downturn. The ratio has become known as the Buffett Indicator in recent years after the investor Warren Buffett popularized its use. Warren Buffetts favorite market indicator has surged to a record high of 142 signaling US and international stocks are heavily overpriced and could plummet in the months ahead. Back in 2001 he remarked in a Fortune Magazine interview that it is probably the best single measure of where valuations stand at any given moment Market Cap to GDP is commonly defined as a measure of the total. Back in 2001 he remarked in a Fortune Magazine interview that it is probably the best single measure of where valuations stand at any given moment.

Source: ar.pinterest.com

Source: ar.pinterest.com

The stock market capitalization-to-GDP ratio is also known as the Buffett Indicatorafter investor Warren Buffett who popularized its use. This ratio now commonly known as the Buffett Indicator compares the size of the stock market to that of the economy. This is from the contribution of economic growth in local current prices. 558T 229T 243 By our calculation that is currently 95 or about 31 standard deviations above the historical average suggesting that the market is Strongly OvervaluedThese are historical all-time highs. The ratio has become known as the Buffett Indicator in recent years after the investor Warren Buffett popularized its use.

Source: pinterest.com

Source: pinterest.com

Meanwhile based on the historical ratio of newly introduced total market cap over GDP plus Total. This ratio now commonly known as the Buffett Indicator compares the size of the stock market to that of the economy. An easy way to analyze if the markets are overvalued is by looking at the Warren Buffett indicator also known as the market cap to gross domestic. Meanwhile based on the historical ratio of newly introduced total market cap over GDP plus Total. Theron Mohamed from Markets Insider writes.

Source: pinterest.com

Source: pinterest.com

Does Warren Buffetts 1 indicator predict market crashes. 015 and valuation reverse to the mean -487. Lately the Buffett Indicator has been flashing a warning sign about the stock market. This ratio now commonly known as the Buffett Indicator compares the size of the stock market to that of the economy. That figure is well above its 187 reading in the second quarter of 2020 when the pandemic was.

Source: pinterest.com

Source: pinterest.com

When the market line is below the GNP line the investment environment is favorable to value investors like. Prior to the house of cards falling the ratio was in a nice uptrend. April 5 2021 924 AM PDT. Back in 2001 he remarked in a Fortune Magazine interview that it is probably the best single measure of where valuations stand at any given moment. Formula and Calculation of the Stock Market.

Source: pinterest.com

Source: pinterest.com

558T 229T 243 By our calculation that is currently 95 or about 31 standard deviations above the historical average suggesting that the market is Strongly OvervaluedThese are historical all-time highs. Back in 2001 he remarked in a Fortune Magazine interview that it is probably the best single measure of where valuations stand at any given moment The four valuation indicators we track in our monthly valuation overview offer a long-term perspective of well over a. It has become popular in recent years thanks to Warren Buffett. The Indicator has proven very reliable if you turn back timecase in point the 2001 and 2008 crashes. The Stock Market is Significantly Overvalued according to Buffett Indicator.

Source: mql5.com

Source: mql5.com

Based on the historical ratio of total market cap over GDP currently at 2097 it is likely to return -33 a year from this level of valuation including dividends. Does Warren Buffetts 1 indicator predict market crashes. The ratio has become known as the Buffett Indicator in recent years after the investor Warren Buffett popularized its use. Back in 2001 he remarked in a Fortune Magazine interview that it is probably the best single measure of where valuations stand at any given moment. Market Cap to GDP is a long-term valuation indicator for stocks.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title current buffett indicator by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 30+ 10000 euros in rupees Trending

- 45+ Market cap for gold List

- 40+ Crypto currency on td ameritrade List

- 18+ Ftse 100 by market cap Popular

- 19++ Kkr market cap Top

- 37++ Wells fargo foreign currency Trend

- 46++ 1000 euros in pounds Wallet

- 46++ Ripple coin live Trading

- 13+ Ripple coin stock price Wallet

- 20+ Apple wallet pay with face id Popular